Lobbyists weren’t eligible for Paycheck Protection money, but California firms got millions

Dozens of California lobbying firms received millions of dollars in emergency federal assistance meant for small businesses to ride out the coronavirus pandemic, though some were ineligible for the program.

Dozens of California lobbying firms received millions of dollars in emergency federal assistance meant for small businesses to ride out the coronavirus pandemic, though some were ineligible for the program.

Backed by the Small Business Administration, the low-interest Paycheck Protection Program loans were subject to long-standing eligibility requirements that included a prohibition on lending to firms “primarily engaged in political or lobbying activities,” meaning they derived more than half of their revenue from that business.

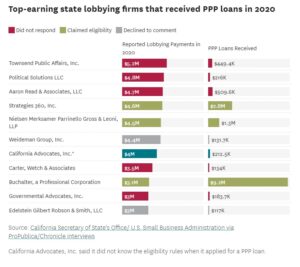

But as many as two dozen firms significantly engaged in lobbying California’s state government, including several of the highest-grossing firms last year, received PPP loans for which they may not have been eligible, worth about $3.7 million total, according to a review of public records and interviews.

The California lobbying firms are part of a pattern of flawed or improper lending in the Paycheck Protection Program, a lifeline for millions of American small businesses hurt by a series of lockdowns and business closures that swept the country beginning in spring 2020. In its hectic rollout, the program benefited some publicly traded corporations and other companies for which it was not intended.

Most of the loans to California lobbying firms were forgiven and converted into grants by this summer, suggesting a failure by the federal government at multiple stages to adequately communicate requirements and vet the eligibility of applicants. Representatives for several firms said they were confused by unclear guidance from the SBA during the application process or were entirely unaware of the restriction on lobbying firms until reached by The Chronicle.

“No, I didn’t know that,” said Mike Belote, president of California Advocates, who confirmed that a majority of his firm’s revenue comes from lobbying for clients such as Apple, Delta Air Lines and the American Beverage Association. “I couldn’t have imagined why I wouldn’t have been eligible. We’re just a small business like everyone else.” Read more >>>